BigCommerce has become one of the best-known names in the eCommerce market.

At the time BigCommerce launched, online sales made up only six percent of U.S. retail sales. However, the founders saw an opportunity for small businesses to increase their sales online through an easy-to-use store builder platform.

Today, BigCommerce powers around 60,000 stores, generating billions of dollars in sales. But how does that translate into market share?

How big is BigCommerce’s market share?

0.4% of all websites are built with BigCommerce. Looking only at hosted-ecommerce solutions, we see this number rise to 3% according to BuiltWith. Shopify in comparison is at 38%.

BigCommerce’s market share hasn’t grown as fast as its competitors in the CMS market

In 2015, BigCommerce and Shopify were pretty much on par in the overall CMS (content management system) market, with BigCommerce’s market share coming in at 0.4% and Shopify’s at 0.7%. WordPress was leading at the time with 60% of CMS-hosted websites. In 2022, BigCommerce’s CMS market share remains at 0.4% while both Shopify (6.2%) and WordPress (65.2%) have grown their slice of the pie.

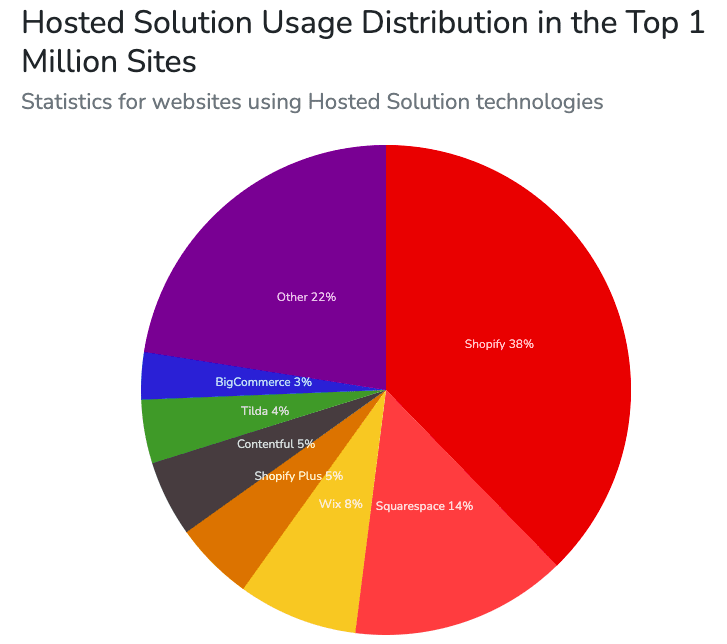

If you look at the top million websites using hosted eCommerce solutions, Shopify still leads with 38% (including Shopify Plus) while BigCommerce grabs just 3% of the market share. Even Squarespace (14%) and Wix (8%) capture a bigger share of the market.

Hosted eCommerce solutions in the top 1 million sites

Big companies make up a lot of BigCommerce’s market share

Although BigCommerce has customers of all sizes, it’s especially popular among mid-size to enterprise companies, which the company defines as companies that make $1 million or more in annual sales. These mid-to-enterprise companies make up half of BigCommerce’s revenue. Additionally, around 80% of BigCommerce’s revenue comes from customers with annual contracts of $2,000 or more.

You may recognize a lot of these brands: Skullcandy, Vodafone, Whataburger, and Ben & Jerry’s just to name a few.

It makes sense that BigCommerce is popular among big (or growing) brands. It has a lot of powerful, flexible features right out of the box that help you track growth without needing third-party integrations, such as:

- Customizable and responsive page and shopping cart templates

- Advanced SEO and analytics features

- Flexible payment and inventory management that supports standard and non-standard third-party payments

- Application integration with vetted third-party apps

- Product filtering

- Corporate account management

BigCommerce’s market share covers different sectors

BigCommerce doesn’t just cover retail (although retail companies do make up 35% of their market share). Their customer base is made up of over nine industries/verticals. Here’s a breakdown of their customers:

- Consumer packaged goods: 17.9%

- Manufacturing: 14%

- Healthcare: 10.7%

- Professional services: 7.1%

- Oil, gas and chemicals: 3.6%

- Transportation: 3.6%

- Government: 3.6%

- Non-profit: 3.6%

BigCommerce serves both B2C and B2B customers, with around 10% of customers using it primarily for B2B as of 2019.

BigCommerce market share covers 150+ countries

In 2010, BigCommerce had just 10,000 customer stores. In 2022, that number is 60,000, with the United States, Australia, United Kingdom, Canada, and India being in the top five. This can be attributed to a few factors, including BigCommerce expanding their teams in Europe and Australia, its launch in Asia, and its expansion of engineering operations in Kiev. In fact, as of 2020, stores located outside of the United States made up 25% of BigCommerce’s customers.

BigCommerce’s revenue grew by 36% in 2020 and kept growing in 2021

As you might have guessed, 2020 was a big year for eCommerce, with more businesses moving online during the pandemic. BigCommerce saw a lot of that gain. It raked in $152.4 million in revenue in 2020, a whopping 36% increase from the previous year. This is not nearly as much as Shopify’s $2,925 million revenue in 2020 though.

In Q3 2021, BigCommerce continued this growth trend, announcing a revenue increase of 52% ($253 million).

BigCommerce’s Prices and Features

BigCommerce is especially popular among big brands, but they offer four pricing tiers to accommodate different types of businesses: Standard (for simple stores), Plus (with abandoned cart options), Pro (with custom SSL and advanced product filtering), and Enterprise, which comes with a dedicated account manager.

Another strong point is that it has no limit on the number of product variants you can add (unlike Shopify, for example). It also has one of the best SEO capabilities we’ve found for a store builder, so your store can reach more people via search engines.

We’ve reviewed BigCommerce before, but wanted to take a closer look at its market share to understand how it stacks up against its competitors. Here are the main things you need to know about BigCommerce’s market share.

BigCommerce’s market share outlook in 2022 and beyond

BigCommerce has, without a doubt, done very well in 2020 and 2021. How does 2022 look for them? With more than 4 billion people online and more brands accelerating their online operations due to the pandemic, BigCommerce’s market opportunity is massive. However, they face a lot of competition.

When it comes to the mid-to-enterprise business market share, BigCommerce named Adobe’s Magento, Shopify Plus, and Salesforce’s Demandware as their biggest competitors.

When it comes to the small business market, BigCommerce is up against Shopify, Woocommerce, Squarespace, Wix, and Webflow.

You can also read a qualitative comparison of BigCommerce vs Shopify, or read a round up of all the best ecommerce website builders.

In terms of revenue, BigCommerce is still way behind Shopify, but with Shopify focusing on entrepreneurs and small businesses, BigCommerce has the opportunity to carve itself a niche in the enterprise market.

THE BEHIND THE SCENES OF THIS BLOG

This article has been written and researched following a precise methodology.

Our methodology